At Jones Financial Group, we take our clients’ security very seriously, so we’re getting in touch to share some tips to help you protect yourself from some common scams.

With scams on the rise and fraudsters using more sophisticated techniques, it’s never been more important to be aware of how scammers can target you and talk to your family and friends to get a second opinion or a second set of eyes if it seems a bit off.

Common scams:

1. Remote access

Scammers may call you and say they’re from a telecommunications or service provider. They may claim there’s a problem with your computer and may ask for remote access to your computer, your personal or financial information, or demand you pay them to ‘fix’ the problem.

TIP Ask yourself, were you expecting this call? If the call seems suspicious, hang up. Never give someone you don’t know remote access to your computer, your personal or financial information and do not install any of their software.

If they tell you to go and make a coffee because it’s going to take a while, or that they are going to send you text messages they need you to read back to them (probably your internet banking codes to steal your money), then disconnect immediately and hang up any phone calls. Ideally turn your internet and computer off and go and get some fresh air at the beach, because you just avoided a scam and potentially losing a lot of money.

2. Business email compromise

Scammers may intercept emails with invoices and change the payment details before they get to you. For example, you may be expecting an invoice from a tradesperson for work they’ve recently done for you. Another common one lately is solicitor or broker emails asking for payments to be made directly to their accounts. These types of emails are generally a scam 99.99% of the time!

TIP If you receive an invoice or payment details by email, always (always!) call the supplier or business on the number listed on their website first to confirm the account details you’ve received are correct before paying.

3. Phishing (no fishing rod required)

Scammers may try to access your personal information by claiming to be from a trustworthy source like a bank, or internet service provider. They may contact you by email, social media, phone or SMS and use this information to attempt access to your banking.

TIP Don’t click on links or open attachments that ask you to provide financial or personal details, particularly if the email or text is unsolicited, unexpected or from an unknown source. If you’re unsure if an email or text you receive is from a legitimate source, call the provider on the number listed on their company website to query it.

Always check the email address it came from because they are slightly different or completely different to the business it apparently came from.

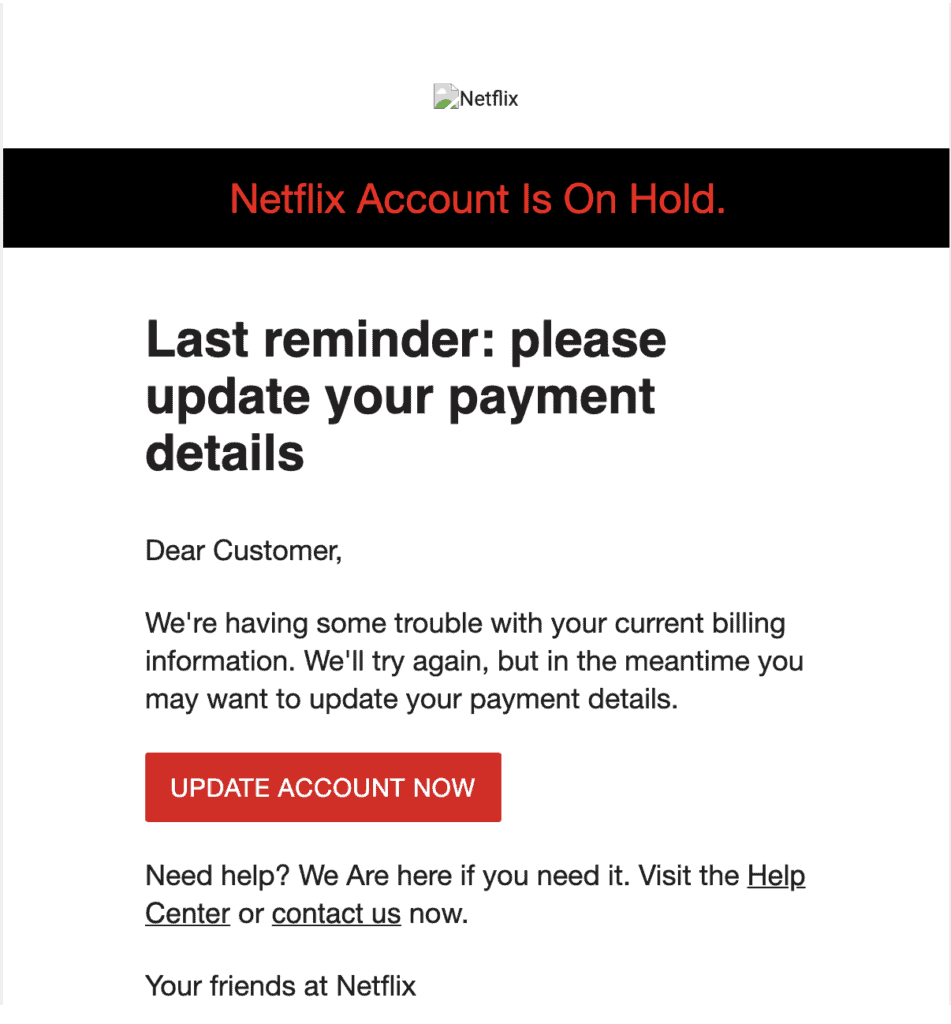

Here’s an example of one we received recently from “Netflix”

Such an easy one to overlook if you don’t think about it around this time of the year, because ‘we don’t want the kids Netflix interrupted’ etc etc.

4. Investment scams

Scammers may claim to offer you financial or investment advice and ask you to invest in an opportunity that promises big returns. It may even appear that you’ve received a return initially once you’ve handed over your money. These scams can go on for months or years, until they stop and you lose everything.

TIP If it seems too good to be true, it probably is. Before investing, always do your research and potentially look at getting independent legal advice or financial advice from a financial adviser who is registered with ASIC.

“25% return on your cash investment” doesn’t exist without a high risk of losing some or all of your money.

Now a lot of the above might sound like common sense or you may be thinking “who would fall for that?”. Unfortunately the reality is that these scam work and this is why you hear of the same scams every year.

Tax season and Christmas season is prime scam season.