The tone of the Reserve Bank has changed to neutral and now the market is clearly factoring in a rate cut, and the scare campaign of rate rises and housing collapse is not necessarily something that buyers need to fear. For those not sure of the scare campaign, an example is 60 Minutes reporting “Bricks and Slaughter – Housing Prices to Fall off a Cliff by 40%”.

On the other side of this is the emotionally ignorant ‘experts’ who flip their opinion more often than an AFL umpire flips a coin during footy season.

The Engineering Behind Reserve Bank Decisions

Now to understand the engineering behind Reserve Bank decisions, it’s important to understand that high house prices are not the sole indicator of rates or rate decisions. Let’s rewind a little and look at the mechanics behind this.

Despite low interest rates, we’ve failed to re-inflate our macro economy. What the heck is macro economy? Well, basically Business Confidence took a hit last year, and looked to the future of what it would look like under a Labor Government. Population Growth remains strong and Income Growth is just about as low as we’ve always had it. We haven’t met our 2-3% annualised growth Inflation Target for about 3 years. Retail Sales have been struggling and were very poor over December.

Grinding Economy

It’s a grinding economy out there and eventually if these factors didn’t improve, which they haven’t, it would have meant that the Reserve Bank would look to make a move to create stimulus and put more money in people’s pockets.

A rate cut, or even some neutral ground, can help to moderate the negative mindset across a lot of buyer’s and seller’s who have been in the market this past few months.

The Theory Behind a Strong Market

The theory has always been that when you get full employment or near it, you’d get competition for labour, which would push up wages, which would then lead into inflation and finally create a need to put up interest rates. These are all markers of a positive economic cycle and rate rises represent that we are in a healthy and strong market.

The current economic activity doesn’t appear to show any signs of higher activity, and predictability in the short term appears consistent. It’s important to note that high house prices are not a sole indicator of rate rises, and there’s really no case for a rate rise except for high house prices in Sydney and Melbourne.

Dwelling Supply

We are at the peak of the supply boom right now, and over the next couple of years we are going to see a significant falling away of new dwellings coming into the marketplace. We may then see a return to under-supply given we still have strong population growth, particularly migration. First Home Buyers are advantaged by lower prices and stamp duty cuts.

Household Sector Concerns

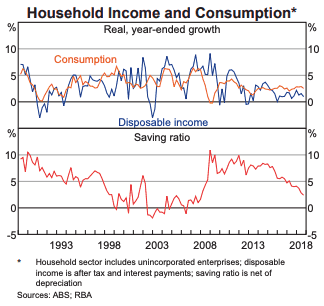

Outside low wages growth, we’ve also seen the family home lose value. So not only have we seen income flow declining, but we’ve also seen people’s asset base declining as well. This is not something that has happened in an organic and orderly fashion like it should… it’s because of interference from policy makers. A concerning number in the Household Sector is our ‘Savings Ratio’ which has grabbed the attention of the Reserve Bank. People are now tapping into their savings, and the Savings Ratio is now as low as it’s been since 2007.

Now back in 2007 people were spending because it was ‘the boom of all time’ and we saw cash being splashed around like drunken sailors on shore leave. The issue we have now is the reverse, and people are spending their savings to survive. That’s why we do need interest rate cuts and/or significant tax cuts in the next budget – which just so happens to be an election budget!

Case For A Rate Cut?

We feel there is a case for a rate cut, however the RBA will likely ‘wait and see’ on Tuesday, leaving rates on hold. If conditions continue to weaken and lead to drive a rate cut, the RBA would likely want to get it out of the way in April to appear bipartisan. Anything in May and closer to the election could appear to represent a partisan decision. The last time rates changed close to an election, it didn’t end up well for John Howard in 2007 when he lost office.

If you’re wondering what you should do, please don’t just read a book and think you have all the answers required to go out and ‘get rich quick’… reach out and get some professional advice. Our door is always open to discuss your options – head over to our Contact Us page or Book an Appointment here.